Saturday, January 23, 2010

Tort Reform Is DEAD Or A Crisis Is Looming

Californians for Fair Auto Insurance Rates Qualifies Initiative for June 2010 Ballot

Californians for Fair Auto Insurance Rates Qualifies Initiative for June 2010 Ballot

Measure expands auto insurance discount for California drivers

SACRAMENTO, Calif., Jan. 20 /PRNewswire/ -- Californians for Fair Auto Insurance Rates, a coalition of consumer advocates, businesses, senior organizations, taxpayer advocates and insurers, announced today that the Secretary of State has certified the Continuous Coverage Auto Insurance Discount Act for the June 8, 2010 Primary Election ballot. CalFAIR submitted 726,199 signatures and needed 433,971 valid signatures in order to qualify. This measure will allow auto insurance companies to offer discounts to drivers who have continuously maintained their auto insurance coverage.

Under current law, insurance companies are allowed to offer a discount to their existing customers who maintain continuous auto insurance coverage, often referred to as a loyalty discount. However, an inconsistency in the law prohibits drivers from being allowed to take their continuous coverage discount with them if they change insurance carriers. The Continuous Coverage Auto Insurance Discount Act fixes this inconsistency and makes the discount portable.

Like the good driver discount, this ballot measure would reward the more than 80% of responsible California drivers who maintain insurance coverage as required by law by making them eligible for a discount, even if they switch insurance companies. That means drivers will be eligible to take this discount with them when shopping for rates, giving drivers more options when it comes to their insurance coverage. The result will be increased competition, which will lower rates and result in reduced premiums.

That's why the measure is endorsed by groups like Consumers First, Consumers Coalition of California, Citizens Against Regulatory Excess, California Chamber of Commerce, Small Business Action Committee, League of United Latin American Citizens, California Taxpayer Protection Committee and many more.

"We are pleased that the Continuous Coverage Auto Insurance Discount Act has qualified for the June ballot. California consumers will be happy to know that by voting for this measure, they will be eligible to take their continuous coverage discount with them if they decide to change insurance carriers," said Jim Conran, coalition co-chair, president of Consumers First and former director of the California Department of Consumer Affairs. "The current inconsistency in the law prevents insurance companies from extending the continuous coverage discount to new customers and punishes good drivers who want to change insurers. That will change when this measure is passed and will provide consumers the opportunity to shop around for more savings and with more options."

The vast majority of California drivers (82%) maintain insurance and should be rewarded for keeping their insurance current.

Insurance companies still will be required to base a driver's auto insurance rates primarily on their driving safety record, miles driven annually and driving experience. Other discounts, like the good driver or student discount, will not be taken away.

For more information, please log on to our website at www.Cal-FAIR.org.

SOURCE Californians for Fair Auto Insurance Rates

RELATED LINKS

http://www.cal-fair.org/

Thursday, January 14, 2010

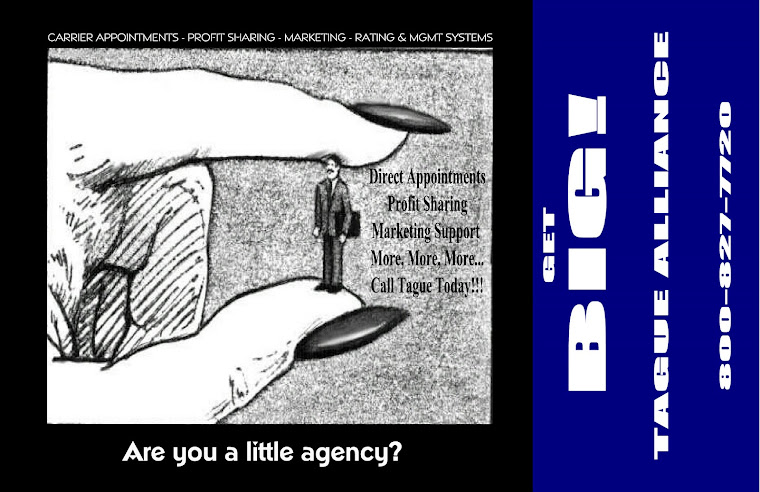

Tague Alliance - Top 5 Things To Grow When Slow

Tuesday, January 12, 2010

Web Design Tips For Tague Alliance and SIAA Members

Friday, January 8, 2010

Using Social Media To Drive Traffic

One of my members challenged my comments about "not selling insurance on Facebook" and her remark to me was that she had sold four policies as a direct result of being on Facebook. I am thrilled at her results. The bottom line is that you need to figure out how to embrace the trend of Social Media. Regardless of whether you are selling insurance as a direct result of using Social Media or are just trying to build a deeper connection with your clients.