Saturday, December 28, 2013

John Wooden Eight Suggestions to Succeeding

“Eight Suggestions for Succeeding” from Wooden: A Lifetime of Observations and Reflections On And Off The Court (which I highly recommend you read!).

1. Fear no opponent. Respect every opponent.

2. Remember, it’s the perfection of the smallest details that make big things happen.

3. Keep in mind that hustle makes up for many a mistake.

4. Be more interested in character than reputation.

5. Be quick, but don’t hurry.

6. Understand that the harder you work the more luck you will get.

7. Know that valid self-analysis is crucial for improvement.

8. Remember that there is no substitute for hard work and careful planning. Failing to prepare is preparing to fail.

John Robert Wooden (October 14, 1910 – June 4, 2010) was an outstanding basketball player and coach. Nicknamed the "Wizard of Westwood", he won ten NCAA national championships in a 12-year period , seven in a row, as head coach at UCLA. Within this period, his teams won a record 88 consecutive games. He was named national coach of the year six times.

Written by:

Tom Jackson

President, Pace 360

Friday, December 6, 2013

Insight On Renting Your Condominium Unit

By Laurie Infantino, I sign nothing, at least that's my reputation.

What is closer to the truth is that I sign "nothing" without first reading it, understanding it, and accepting the terms of what I am being asked to sign. That is not the case with most people, which surprises me.

My husband and I own a condominium unit in Steamboat Springs, Colorado. We are part of a condominium association, have reviewed the CC & Rs and both the association and we carry the appropriate insurance coverage. So far so good?. Here is where everything goes array. The condominium association contracts with a management company to manage the property. In addition, each unit owner who has their unit in the rental pool, individually contracts with the management company to rent their unit.

All of that being said, what would then be appropriate in terms of the contract between the unit owner and the management company? In my opinion it is the unit owners who should require the management company to minimally provide evidence that they carry Liability Insurance; Business Auto Insurance for the shuttles they operate on the unit owners' behalf; and statutory Workers Compensation. Additionally, it would appear appropriate that the unit owners would require of the management company a hold harmless and indemnification clause on behalf of the unit owner and be named as an additional insured on the management company's policy. That would be appropriate.

But that is not the way it works, much to my surprise. If you actually read the management agreements, it is the management company that requires the unit owner to name them as additional insured on the unit owners' Liability Policy; provide them with a hold harmless and indemnification clause. It gets worse, the contract requires that the owner shall carry liability and property insurance on the unit as well as coverage on their personal property and contents in the Unit in such amounts and of such types as the manager shall reasonably deem sufficient to protect the interests of both parties. All such policies shall be so written as to protect Manager in the same manner and to the same extent as such policies protect Owner.

So what that means, in simple terms, is that the manager is dictating to the unit owner the type of insurance they are to carry (even on their personal property); telling them how much coverage to carry; and requiring that the property and liability policy protect them to the same extent it protects us. That is not even within the realm of possibility, especially from the aspect of the property insurance contract under which they have absolutely no insurable interest.

I asked our own insurance agent, one of the brightest personal lines professionals I have known, if she is familiar with these types of requirements. Her answer was yes, she is often asked to provide additional insured status, hold harmless and indemnification clauses on behalf of management companies. She went on to say, her insurance companies won't do it and rightfully so. So, that leaves us, the unit owners, holding the bag. Sign it and pay the piper because our personal insurance sure will not provide protection for these outrageous requirements.

www.InsightInsuranceConsulting.com

Check out my ICC Profile Page: http://insurancecommunitycenter.com/insightinsuranceconsulting

Sunday, December 1, 2013

Property Endorsements Common but Seldom Used

By Robb Greenspan,SPPA As the old adage goes, hindsight is 20/20 vision.

As a Public Adjuster (PA) representing the Insured’s interest only in property claims, I am in a unique position to evaluate the insurance needs of your clients with the benefit of hindsight and long experience. When I visit a loss, I think to myself, “if only they carried certain coverages” or “if they had only added this endorsement” or “if they had increased their limits here, they would be in a better position to make this claim.” Obviously, this does little to help an Insured after a loss has occurred. However, with a little foresight, planning and risk analysis, not only can you increase the quality of your client’s coverage, but they will know what great a service, you, their broker/agent, provided them once a claim hits. Let’s look at some of the property policy endorsements that are out there but not used near enough.

Real Property Coverage

One of the most important coverages is Increased Cost of Construction Endorsement or Building Code Coverage. This coverage is especially valuable when you are writing a building risk that is very old or not well maintained or in an area that has especially rigid building codes. In today’s world, almost from the date of construction, buildings need code and ordinance coverage. Obviously, newer buildings need this coverage less often than buildings over 10 years or older, which will require an extensive amount of retrofitting to bring them up to today’s current codes. This coverage pays for all construction costs not attributed to your client’s insured damage, but required by the building authorities due to a loss in the reconstruction of the property. In other words, the insurance company will pay the cost to bring the building up to present day code requirement.

Agreed Value Endorsements

These endorsements can be useful in avoiding valuation problems, i.e. co-insurance. Once a loss occurs, the insurance company will look at the values at risk versus coverage purchased and in many cases there are requirements (contribution clause) that require the Insured to insure to certain minimums. Failure to maintain those minimums and the Insured becomes a co-insurer, and by using a formula spelled out in the policy, will pay part of their losses out of pocket.

There are a number of ways to arrive at the value of a building; the market value approach, appraised value and building square footage calculations are just a few. Although the courts have ruled on this, many companies still choose their own method of valuation which produces a variety of values and consequently, problems. The easy solution to avoid value problems is an agreed value endorsement which, if written on the risk, allows the company and your insured to agree on the value ahead of time, thus preventing problems (co-insurance) at a later date. Keep in mind that the claim still needs to be adjusted; however, it does eliminate the specter of co-insurance.

Another methodology of insuring multiple buildings and avoiding the specter of co-insurance is to blanket the coverage. Although technically, co-insurance still may apply, it is rare that the insurance company will check the values of all buildings when only one is damaged and thus, if there is not sufficient coverage on a specific building involved in a loss, we can “rob Peter to pay Paul” by taking values from the other buildings during a claim situation. This is a preferred methodology of valuing your property over individual limits when multiple buildings are insured.

In most cases all buildings in Southern California that have sprinkling systems should have Earthquake Sprinkler Leakage coverage (EQSL). This covers the cost of water damage caused by an earthquake and in buildings with sprinkler systems, the most likely cause of damage. Due to the excessive cost of earthquake insurance, many of your policyholders will not carry EQ insurance however, if this building has a sprinkling system, EQSL is a must.

Personal Property Losses

One of the more important coverages under the category for Business Personal Property or Contents would be an agreed value endorsement. This is beneficial in my view because it takes the risk of co-insurance out of the picture as we demonstrated in our discussion under Building. The insurance company and your insured agree on a value in advance whether actual cash value or replacement cost and this becomes the limit of coverage, thus avoiding coinsurance clause again. Make sure your client understands that you are agreeing on this value and that he is accurate in his calculations of those values. You will have to live with them once the loss occurs.

If your Insured is a manufacturer or retailer who produces a product with name recognition, this next endorsement is very important. Brand and label endorsement can save your Insured many headaches. Take for instance a manufacturer of men’s leather coats. A small fire happens in the finished goods area of the factory and a thousand units are affected. During the course of the adjustment, the insurance company agrees with the Insured that they cannot sell these slightly damaged items and pays the policyholder for them. The insurance company allows the items to go to a salvage company. Salvage companies sell distressed and damaged merchandise on behalf of insurance companies to help get them reimbursed for claims paid - sounds simple, but not so. Without the endorsement above, the Insured’s goods can and probably will be sold on the open market (possibly entering into the Insured’s own sales territory). These goods are distressed and the Insured is not allowed to alter or remove their label. The risks to the Insured are as follows: 1) the consumer buys distressed merchandise thus affecting the Insured’s reputation for quality, 2) the Insured may receive countless returns because of the damaged state of merchandise and unable to discern between distressed goods and new goods not affected by the claim and 3) the Insured has no say as to where these goods will be sold.

With the above endorsement, the Insured can be paid to alter or remove their label or put an identifying mark on the label, thus identifying them as salvage or distressed. The Insured will have some control as to the markets these goods are sold in and will be able to identify them if returned for warranty repairs. Without this endorsement, the Insured has no control of their salvage.

The example above brings up another coverage - finished goods endorsement. This pays the Insured his selling price of all finished goods, (not the cost actually incurred by the Insured to manufacture those goods). This is preferable to the usual selling price endorsement which reads “goods sold but not delivered” for it covers all finished goods and pays the selling price. Keep in mind that the Insured is in the business of making a profit not manufacturing goods and being reimbursed at cost by the insurance company.

Tenant Improvements and Betterments

Tenant Improvements and Betterments (TIB’s) usually insured under the personal property section of the policy is a source of much confusion and dispute. When improvements such as walls, partitions, plumbing, electrical equipment, whether attached to the building or not, become damaged in a loss, the question of ownership and the basis of reimbursement always comes up. Will the tenant and landlord be reimbursed based on a “use interest” basis? Actual cash value of the TIB’s or no reimbursement at all? Should the lessor’s policy pay or should the lessee’s policy pay? Who owns the TIB’s? The landlord or the tenant? Although the lease may or may not address these issues, the insurance company will not only look at the lease but who paid for those improvements and are they or are they not attached to the building? Care must be applied when writing coverage for either tenant or landlord to make sure you insure them properly. The endorsement for Tenant Improvements and Betterments can be modified or manuscripted and made better if the following language is added: the tenant improvements and betterments, any lease or agreement to the contrary not withstanding shall be considered property of (landlord/tenant, you choose) and reimbursement will be made accordingly. This can eliminate any confusion.

Time Element Losses

Retail stores, restaurants and some manufacturing concerns can benefit greatly from the extended period of indemnity endorsement, which increases the suspension time of your loss of income claim beyond that which is normally paid in a loss situation. For example, when a restaurant suffers a fire loss, as adjusters we would calculate the time it would take to rebuild and add to that a period for the adjustment process and that would be the theoretical suspension claim. That is what the insurance company would use to base the loss of income claim on and pay no additional time after the theoretical period, regardless of whether or not the building was built in the right amount of time. With any type of service business that is closed, you run the risk of customers developing new buying habits or in this case, eating habits. With this endorsement, the suspension period can be increased for a specific period of time over the claim period by 30/60/90/120 days, etc. We would look at what the business should be doing versus what they are doing and the difference would be paid. Remember, this endorsement increases the liability of the insurance company by a specific amount of time after the normal loss period ends. You may need to add some additional coverage for amounts to cover this additional time period. Remember to always try and consult with your clients accounting department or outside CPA professional in order to determine the amounts needed for business income coverage. You can always consult with a qualified public adjuster, who is knowledgeable in each discipline, accounting and insurance, for suggestions on proper amounts of coverage as well.

Agreed Amount Endorsements can be applied to loss of income insurance (time element) as well, which will again waive the co-insurance clause in the policy and avoid the associated problems with values. This applies as it does under Personal Property or Building losses.

Since Hurricane Katrina, we noted that there is an endorsement that agents and brokers rarely write that is needed in the event of disasters. Whether in the Gulf states or here in California, that endorsement is Off Premise Power. Especially relevant in Southern California where we have rolling blackouts and power failures, this endorsement allows an Insured to make a claim for the power failure which can affect today’s businesses as we rely more and more on electricity and data communications. When looking for a form to write for off premise power, please make sure that you pick the right one, whether for overhead transmission lines, underground transmission lines and one that includes interruption of communications and data, i.e., phones and internet service. In today’s world, this is very important.

There many more endorsements that can be used and are made for specific types of risks. They all should be studied carefully to see if they are appropriate for your client’s needs. Sources of reference that you can use are the FC&S Bulletins, ISO; however, there are many other resources available to the broker/agent. I would always recommend consulting with a qualified public adjuster on particularly complicated risks as to how a specific endorsement might affect the outcome of a claim. Keep in mind that we Public Adjusters look at policies differently than the underwriting department that you tend to talk to. We see the working end of the insurance policy, not the theoretical one that underwriting tends to sell to you. In other words, policies forms do not always work in the field as underwriting believes they will be applied. A qualified public adjuster is an invaluable source to consult with and give advice as to how to write a risk properly.

One must always weigh the economic considerations of each additional endorsement sold. By recommending various endorsements to your clients and giving them a choice, you not only perform a great service to them, but you can avoid errors and omissions claims down the road for failing to write or recommend the proper coverages. As always, I will always recommend that any conversations you have with a policyholder be confirmed in writing and at least once a year, you make in writing, an offer to review coverages with your client. You will understand the value of these last two recommendations if and when you are ever faced with an errors and omissions lawsuit.

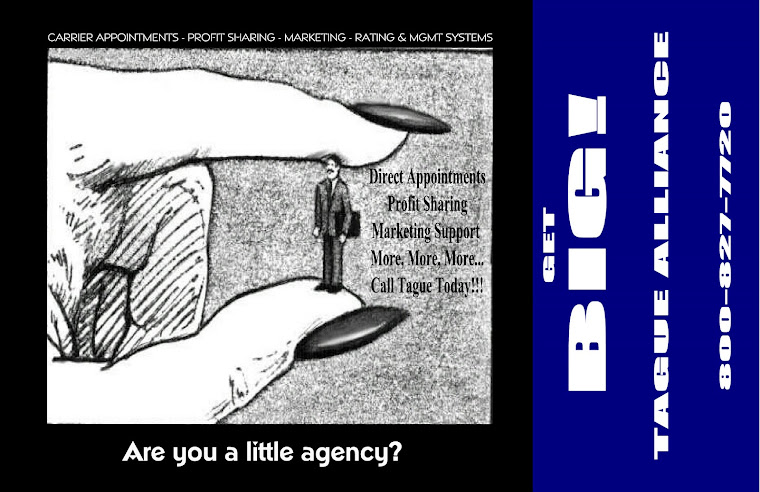

Visit Tague Alliance for more information on becoming a member: www.TagueAlliance.com

About the Author:

Robb Greenspan, SPPA is a senior partner and second generation owner of The Greenspan Company/ Adjusters International, a public adjusting firm was established in Los Angeles 1946. Greenspan is dedicated to representing the policyholders interest in property claims only. He has written numerous articles and papers on insurance and teaches continuing education for agents and brokers as well as other professionals for over 20 years. Greenspan is currently a member of the Curriculum Board for the California Department of Insurance and past member of the Insurance Commissioners Consumer Complaint and Unfair Claims Practices task force. He holds the Senior Professional Public Adjusters accreditation issued by the National Association of Public Adjusters.

TEL:818-386-1313

Email:robb@greenspan.com

Subscribe to:

Posts (Atom)